All Things Money Lite

All Things Money (ATM) was created with the mindset that good finance software doesn’t need to be expensive, to contain advertisements, or to log into your bank account. It should be comprehensive and provide interconnected services. It should also be efficient by supporting multiple input formats, auto-completing certain fields, and automatically logging recurring transactions. ATM delivers on these goals and more.

If you are curious, please give it a try. Download All Things Money Lite for free to determine whether ATM is a good fit for you. When you want to upgrade, use the export and import menu options to transfer data between apps.

ATM capabilities include the following.

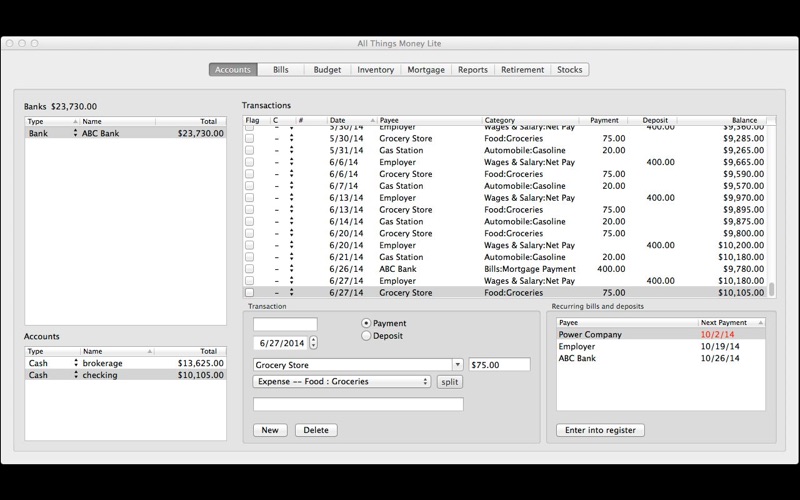

Account Dashboard

- The innovative layout gives perspective to all of your liquid assets.

- Track bank, credit card, stock market, and U.S. savings bond accounts.

- Calculate net worth.

- Sort transactions.

- Split transactions.

- Add memos to transactions.

- Import bank, credit card, and stock market transactions from QIF and CSV files.

- Import bank and credit card transactions from OFX files. (At this time, stock market transactions are not supported via OFX imports.)

- Import U.S. savings bonds from treasurydirect.gov HTML files.

- ATM auto-fills payee names and categories.

- The bank-account paradigm enables you to earmark money.

Bill Planner

- Track payments and deposits.

- Track automatic stock market trades that are typical of 401k-type accounts.

- Elect to automatically move up bill dates to avoid weekends and U.S. holidays.

- ATM supports the following payment intervals: daily, weekly, bi-weekly, semi-monthly, monthly, bi-monthly, quarterly, once every four months, semi-annually, annually, bi-annually.

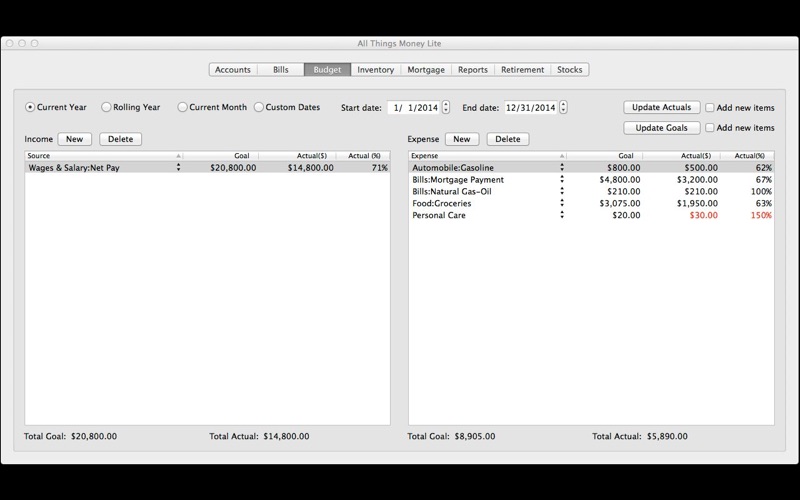

Stay on Budget

- Create a budget based on transactions from the prior year.

- Update budget goals based on your expected bills and deposits.

- Update actuals from account transactions.

- ATM supports annual, monthly, and custom-period budgets.

- ATM provides color-coded alerts to track spending excess.

Plan for Retirement

- Seed the retirement calculator with your account information.

- Calculate how much money you will have when you retire.

- Calculate the annuity that your retirement will generate.

- ATM also includes a general-purpose, compound-interest calculator that has six unique equations and two combination options for expediency. This calculator enables reverse computations; it calculates how much money you need to retire based on your desired annuity, interest rate, and life expectancy.

Monitor the Stock Market

- Create a watch list that saves stock symbols and time intervals.

- Display a stock’s price and volume alongside technical indicators like Bollinger Bands and Moving Average Convergence Divergence (MACD).

- ATM supports daily and weekly stock charts.

Mortgage Analysis

- Create an amortization table and track your mortgage balance as you pay down principal.

- Compare the costs of buying and renting.

Inventory Tracking

- Keep track of your collections.

Create Reports

- Generate plots of net worth and stock prices.

Lite Version Restrictions

- One bank

- Two accounts

- Three bills

- Two stock watch list entries

- Two inventory categories with three items each

- Two retirement calculations per session

- One compound-interest calculation per session

- One amortization calculation per session

Minimum requirements: screen resolution of 1280 x 800 or higher.